Even if you need to have a call with the accounting software sales team, you can quickly get help to figure out which plan is the best fit for your business. And if you need to power up your business’s accounting software as your company grows, you can do that. Most of the best accounting software programs will help you track your business income and business expenses automatically without you having to create spreadsheets and do manual data entry. As a bookkeeper, you will verify and balance receipts, keep track of cash drawers, and check sales records. Bookkeepers also deposit money, cash checks, and ensure correct credit card transactions. You will want to do your research before pricing your services, and you will also want to maintain some level of flexibility to adjust your rates in the future.

Pro Small Business Accounting Software by Intuit

You can hire someone to come in on a per-project basis and only pay for the time they spend on the project or for an agreed-upon time. According to Salary.com, the average bookkeeper salary in the United States is $45,816. It also assumes the bookkeeper is entry-level with no specialized experience or qualifications. As your business grows, you will need to focus more on detailed financial reporting and following state & federal regulations. This requires a more concerted effort and direct oversight by a qualified professional.

- If you need services a bookkeeper doesn’t typically provide, you may need to hire an accountant or CPA firm instead.

- The Ascent, a Motley Fool service, does not cover all offers on the market.

- The only drawback of paying a full-time accountant is that you may need to offer them employee benefits.

- While these exact figures can change over time, the cost comparisons of covering your bookkeeping and accounting needs can vary greatly depending on the type of individual you hire.

- Because of these factors, advancing your bookkeeping career to a role in accounting can be advantageous.

Per transaction pricing

- There’s no extra fee or hourly charges for support—we’re always happy to nerd out about bookkeeping and your financial statements.

- The average annual salary for bookkeepers is between $37,000 to $47,000 (per Salary.com).

- The number of tasks you assign to them directly impacts the price of each bookkeeping service.

- Every business step requires capital, from transforming an idea into a model to investing in its expansion.

- We provide our clients with a modified form of cash basis bookkeeping.

- The company not only helps you prepare for tax season but also offers ongoing tax advice throughout the year.

- Its bookkeeping service comes with its Enterprise plan, which costs $399 per month when billed annually.

Every company, even a small one, requires bookkeeping to maintain a healthy financial position. Bookkeepers can handle the organization and recording of financial records, but they aren’t usually certified to prepare and file taxes. Whether you do the bookkeeping yourself or hire someone to do it, certain elements are fundamental to properly maintaining the books. Some of these elements are done more regularly than others to ensure that the books are always up to date. Other elements are completed at certain time periods as necessary to complete a business task.

- For example, in Massachusetts, in-house bookkeepers earn 20% more than the national average, whereas in Kentucky, they earn 22% less than the national average.

- Some of these elements are done more regularly than others to ensure that the books are always up to date.

- This helps match the right bookkeeper’s expertise and service level to your business.

- The more experienced the bookkeeper, the more confident they are with their skills.

- As a business owner, you’re acutely aware of how precious a commodity time is.

What to Look for in a vCFO Service Provider

A major and effective way to do that is to move to a remote or hybrid work set-up. In this article, we’ll explain the certification levels, as well as the key benefits of honing your TaxDome skills and getting certified. Recognizing the significance of practical application in bookkeeping, we’ve ensured our software, TaxDome, can be tailored to your practical needs. To learn how to set it up for efficient bookkeeping, download our checklist. The best way to do bookkeeping for small businesses is to come up with a framework, choose the method that works best for your business type, and keep track of all the details.

The Indirect Costs of DIY Bookkeeping

Rates can vary widely based on elements such as a business’ size, industry, location and specific needs. Understanding them will help you budget appropriately and set realistic expectations when pricing services. Freelance bookkeepers often come from different backgrounds, but this doesn’t mean they necessarily offer lower prices for their services. That’s why it’s important to consider a person who has at least a bachelor’s degree. If you hire self-employed bookkeepers from another country, you can also experience major cost differences.

Best Online Bookkeeping Services (

- Susan Guillory is an intuitive business coach and content magic maker.

- However, any error or oversight that may appear on the sheet is fully at your business’s expense.

- You can also find experts in numerous accounting software that charge more.

- As a small business owner, you want to make well-informed decisions about financing your bookkeeping expenses, and you want to do it correctly.

- However, there’s no set cost for hiring a professional to manage your business’s finances.

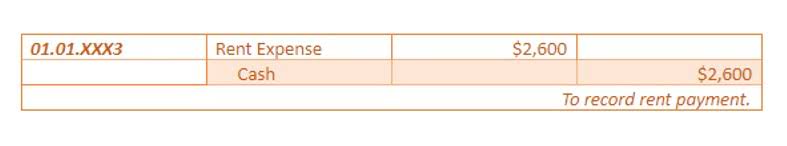

A bookkeeper’s job comprises maintaining and balancing financial records, including transactions from coworkers. Effective communication is essential for recording those daily transactions. Every business step requires capital, from transforming an idea into a model to investing in its expansion. As a professional bookkeeper, you would keep track of a company’s financial transactions and record them in the general ledger accounts.

A professional accountant (or Certified Public Accountant) can help with business tax planning, file your corporate tax return, and make suggestions to help you improve cash flow. If your small business needs financing, whether it’s business credit cards or small business loans, you may bookkeeping price packages need up-to-date financial statements and/or business bank account statements. Staying on top of these crucial financial tasks can help your business qualify for financing. KPMG Spark is a fully online bookkeeping service that offers easy onboarding and integration with your bank.

It’s the future in a changing accounting industry, where you can utilize tech to increase efficiency and output. In this article, we’ll explore everything you need to know about the cost of payroll services. Discuss how bookkeepers leverage software, automation, and AI tools to maximize efficiency and minimize manual work. This can result in significant time and cost savings that get passed on to you.